Tesla – No Individual Company Matters That Much, But Here We Go

As part of our overall mission for transparency, every year we present a detailed analysis of at least one of the year’s major investments.

A great stock is like an orchestra; when all the pieces are playing together in tune, it makes beautiful music. And right now, that’s exactly what Tesla is doing.

No Individual Company Matters That Much—But Here We Go

As part of our overall mission for transparency, every year we present a detailed analysis of at least one of the year’s major investments. And every year I also make the following disclaimer:

It is extremely important not to pay too much attention to any one company. In fact, getting emotional about any single investment can be a distraction, a trap, and a roadblock to sound thinking. And remember, we can be in a company today and out tomorrow based on some new fact or analysis.

What is important is to see how we evaluate companies, and we hope that by reading the following analysis you will gain further confidence in our ability to pick companies wisely. If you choose to read this full write-up on Tesla, do so with an interest in learning more about our thought processes, not with an attitude that any single investment makes or breaks our portfolio. It most certainly does not.

And if you choose not to go through all this analysis, all we can say is… we don’t blame you! This is a lot to read! More importantly though, there is enough macro-level data and overall performance information elsewhere in this report, and in previous reports, to make our case without your deep- diving into the minutiae of each company. Don’t feel bad about skipping the analysis part.

For our part, though, if we are going to present this analysis, there is only one way to do it: fully and completely. That is the nature of understanding and analyzing companies—it has to be done from every angle. We are top-down, bottom-up, and inside out. All the catchphrases apply: “We need to look into every nook and cranny.” “The devil is in the details.” Those details, or fundamental premise points, are what can steer a smart investor away from a phantom “opportunity” or help him or her hone in on a hugely successful idea that can pay multitudes of profits.

We will certainly not get our premises right every single time, but if we can outperform our peers by just a few percentage points, on average, per year, that will make a dramatic difference in your net worth over time. We have done that, and a good deal more, since our inception.

Now, let’s have some fun and dig in!

Tesla is one of the 25 companies that meet our investing requirements in spades (but remember, we only need a handful). Tesla is complex. But that’s why it serves as a beautiful case study. We love complex. The more complicated the scenario, the more mispriced the asset can be. And the more mispriced assets we hold, the better the long-term potential.

TSLA – Tesla Motors Inc

A great stock is like an orchestra; when all the pieces are playing together in tune, it makes beautiful music. And right now, that’s exactly what Tesla is doing. Any way you look at it, the risk/reward formula is off the charts—if you know how to evaluate it properly.

How Long Have We Been Looking at Tesla?

All great investments start with a seed, or an idea or thought. That seed starts to grow, then it is tested and retested, monitored and reviewed, and re-reviewed, to make sure all your premises are covered. In the case of Tesla, this was a company I had been watching for a while.

As you may recall, we noted Tesla’s potential in 2013 and wrote about it in our 2014 annual letter:

“…One example of a bottom-up read is Tesla, where it’s the company’s position in one of the oldest industries in the world, its infrastructure, its vision, and the product itself that grabbed us more than anything else. We read the reviews, saw the car, and actually drove it. We got in at its relative infancy date and its early market cap of $4.5 billion. It is now valued at $21 billion and still, we believe, a bargain over the long run.” (Today it’s around $30 billion.)

And we actually found it and started monitoring it quite a bit earlier than that. We were talking about it extensively a full seven years ago, when I commented on it in my letter to Buffett, under “Future Investment Ideas”:

There are cars existing and coming out that are pure electric—and they seem to be wonderful, and are right around the corner. The Tesla is one such car that boasts a faster 0-60 than most top sports cars, provides over a 240 mile range per charge (critical because previous electric cars could only get 60 to 70 miles per charge), has gotten the charge time down to approx. five hours, has absolutely no noise…, great torque, a fraction of the cost to “fuel” the car, and a reasonable price (around $90,000)—for a beautiful sports car. Moreover, the price will go down if and when it becomes mass produced or other car manufacturers increase their output of electric/hybrid cars. The point here is that they have already made the car, and this and other electric cars are not some pipe dream. The car is close to release and Tesla has stopped taking orders due to the strong demand.

Excerpt, Letter to Warren Buffet, 2008

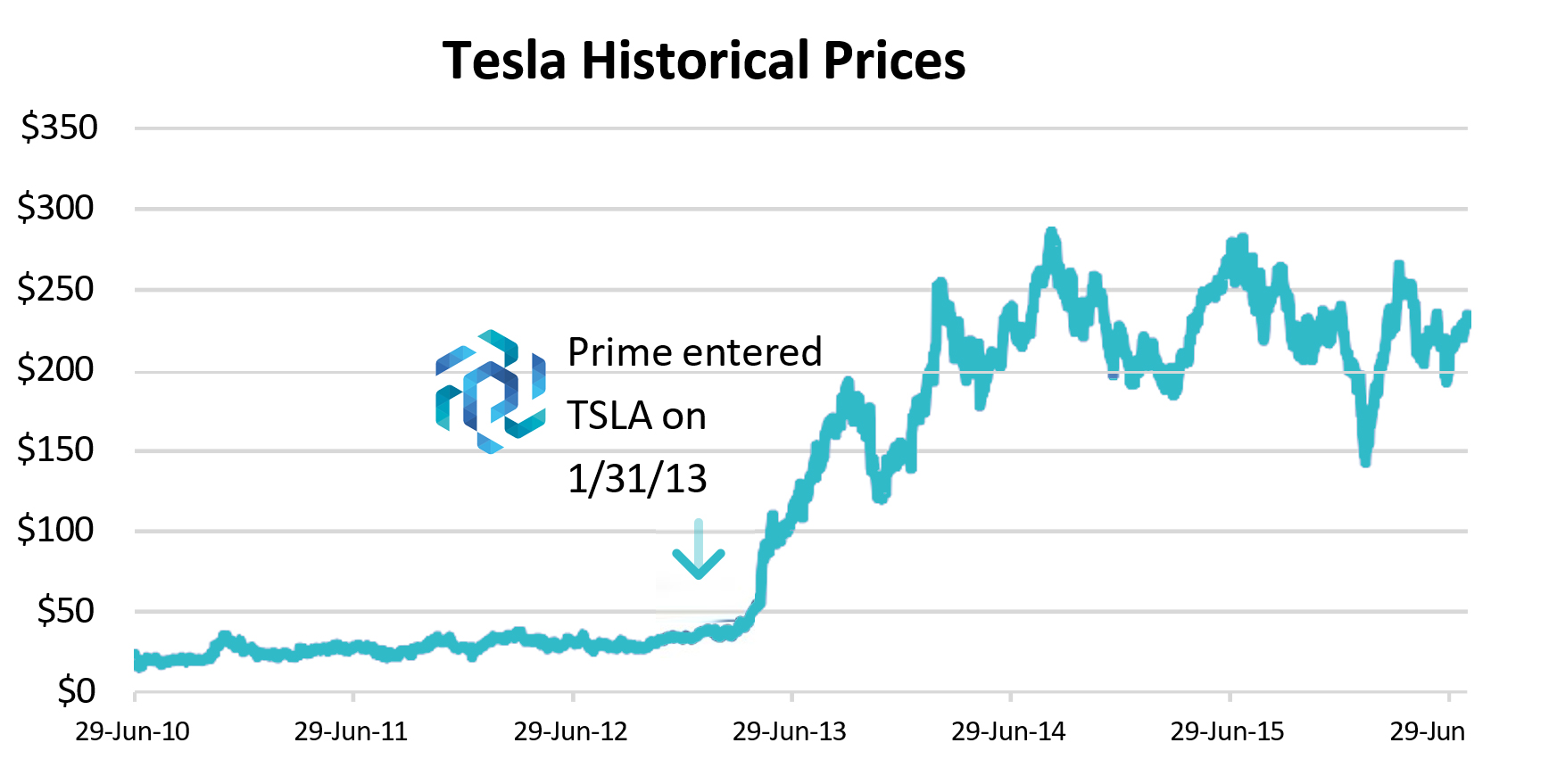

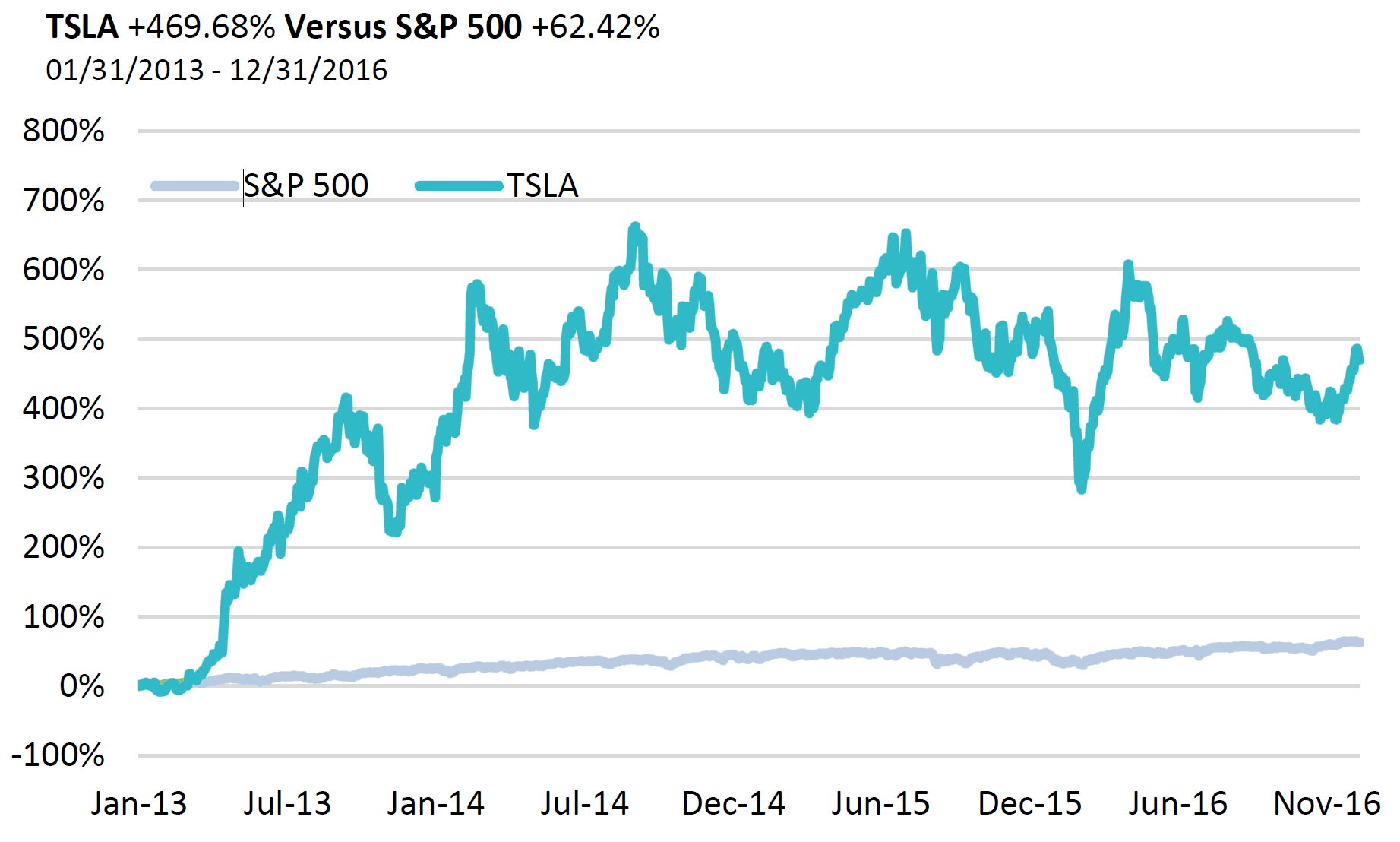

Despite having spotted the opportunity in 2008, I didn’t actually make my investment until January, 2013. Remember, a big part of Prime’s success stems from not only finding the right investments, but also getting in and out at the right time.

Look at when we entered and at what price!

We got in about two years after Tesla went public, and at about a $4 billion market cap—way before anyone saw this company as a rising star. What’s really amazing is that we got in not when TSLA first went public, but right before it took off. We watched it, but didn’t invest until we could see the car for ourselves, and, more importantly, drive it. We always maintain a healthy skepticism, but we also know that outsized returns depend on seeing an opportunity early and taking advantage of it. To do this, you must get in before the crowd does, get out at the right time, and modify your positions based on value already achieved.

We got into Tesla after the Model S was rolled out. Since that time—even through the rollout of the Model X— Tesla has remained, in many ways, the same car company as it was three years ago. It has introduced only one new product since we bought it—and that was fairly recently. Most of the stock appreciation we’ve enjoyed has been a factor of seeing the obvious back in 2013. In retrospect, the decision to buy looks like a foregone conclusion—just as it does with many, if not most, of the investments we make. Our analysis of Tesla, however, was highly controversial at the time. Many people were naysayers. Their arguments all seemed to boil down to, “How could you invest in a company that is losing money with each car it produces?”

So it has always gone with Tesla. If I’m being honest, the reason I have not gone into deep detail about Tesla until now is that there was so much emotion against this company that I thought it might be fruitless to try to explain our enthusiasm for it. Sometimes, the best proof is the one that comes with time. And why call attention to a third rail, especially when it represents only one of about fifty (25 long/25 short) investments we are making?

There was also a lot of fogginess around Tesla and electric cars in general, but now that fog has begun to lift a little, and I think the platform exists for much more open, objective dialogue. The most compelling reason for discussing Tesla at this point in time, though, is that the future for this stock still looks so promising.

Many of the points we will be making in this section have been thought and rethought about, and at the end of the day we will have to wait and see if we are right. We have tried to articulate many of the popular counter-arguments, too, as we have done in past reports.

We have a high degree of confidence that Tesla will go as we predict, based on the evidence we will present below. Even if we are not right about all our points, we think there is such a large margin of error between Tesla’s current market cap and what we think this stock is truly worth that this is essentially a no-brainer once all the facts are compiled. But—with the Gigafactory and Model 3 yet to come—only time will tell, and we will remain open to any new facts and arguments that may arise in the future.

Listening to the Analysts: Just One Part of the Puzzle

One indication of the negative sentiment that existed around Tesla when we bought in was that it received “sell” recommendations from many prominent analysts. You have to understand, this was at a time when you rarely saw a “sell” rating. The percentage of “sell” recommendations was extremely small—less than 1% of the 28,000 stock ratings provided by First Call/Thomson Financial as of May 2000. By contrast, approximately 74% of stock ratings were “buy” or “strong buy.”

Even now, Tesla short sellers are at a record high—about 25% of Tesla shares are being shorted, according to Markit. A surprisingly low 48% of analysts have given the stock a buy rating, while 26% have recommended hold and another 26% have recommended sell, according to Bloomberg.

So what are we to make of this? Should we pay attention to the analysts or not? Well, we all know that the analysts are not always right, to put it mildly. In fact, there has been a great deal of academic research to prove that analysts do no better, on average, than dart throwers.

Since 2008, for example, analyst data supplied by Thomson Reuters and stock performance data from FactSet show that if you had invested your money each year in the ten S&P 500 stocks most recommended on Wall Street, you now would be sitting on a 61% gain. By contrast, if you had simply followed the general S&P 500, you would be up 67%. But here’s the really shocking part: if you’d invested your money each year in the ten stocks with the worst analyst recommendations, you’d be up 180%—about three times as much.

This is not to say that you should automatically go against analysts’ picks, or that we automatically do so. Analysts’ opinions, in fact, comprise one piece of the puzzle we do look at. The point is that we do our own homework, and if a decision makes sense to us—regardless of what others think— we go with our own view of reality.

And remember this: opposition is good. In fact, if I don’t see a strong opposing position to my stock choices, then the upside potential I seek would probably not be there. Why? Because if everyone liked the stock, its price would be a lot higher. So opposition is not something I’m scared of. I welcome it and have seen it with almost all of the investments I have made. Incorrect popular opinion is what creates the outsized opportunities. The beauty of the market is that the truth will eventually prevail.

But there’s also another reason I welcome opposing opinions. They help me to better crystallize my own understandings. In short, we at Prime like to analyze everything, “positive” and “negative,” and when we know we are on solid ground, we move forward.

In order for us to get excited about a company, we need to like the product it makes, its management, its industry, and its growth opportunities within its industry. We’ll talk about the macro perspective in a moment. For now, let’s just look at the product. Tesla, the car.

I’m a skeptic at heart. I doubt everything. I test every premise I hear. That’s why I generally prefer stock investing to venture capital investing. Everything under the sun can go wrong with start-ups, from the validity of the initial idea to the reality of the end product. The premises, in short, have yet to be proven.

But when I see a product that is already out in the marketplace, it is a “proven” concept for better or worse. I can test it, buy it, research it, talk to people who own it. Then I can connect the dots going forward and take advantage of the opportunity. Or not.

That’s what I did with Tesla. Before I bought the stock I actually drove the car. My brother bought a Tesla and I gathered opinions of others who did. I took note of the fact that just about everyone else who owns one consistently raved about how amazing it was. I read the press, I looked at the surveys. My personal experience, combined with the opinions of many, many other consumers and automotive experts, helped me establish one of my fundamental premises: the Tesla is special.

And it’s not just the fact that this is an electric car. If you remember, Fisker Automotive came out with an electric car that I think many would argue looked even nicer than Tesla’s. But Car and Driver and Consumer Reports gave it awful reviews.

When you combine the electric car concept with Tesla’s bold design ambitions and an incredible CEO like Elon Musk—and then you see the car for yourself, drive it, test it, and personally validate the enthusiasm—you know you have the elements needed for takeoff. And takeoff in a huge industry with plenty of upside.

The Cold Hard Facts: The Car Itself

The Tesla Model S was introduced in June 2012 and has been competing head-to-head with established car companies, all of which have well over 50 years of experience behind them.

Even in its first iteration, the Model S…

- won major awards including the 2013 Motor Trend Car of the Year—it was the first COTY winner in the award’s 64-year history not powered by an internal combustion engine—and the 2013 World Green Car of the Year

- was named Automobile magazine’s 2013 Car of the Year

- rated as Consumer Reports’ top-scoring car ever

- earned the Car of the Century distinction from Car and Driver

- scored a perfect 0 NHTSA automobile safety rating—the highest safety rating ever from the National Highway Traffic Safety Administration

That was all before 2016, when Tesla completely updated the design of the Model S. The latest edition of the Model S received a score of 103 from Consumer Reports, which was a problem only in that Consumer Reports ratings are scored on a scale of 1 to 100. Yes, Tesla broke the scoring system. (The magazine had to revise its scale in response to the record-breaking result.)

Perhaps the most important of all of its achievements is owner satisfaction. Some 98% of owners in the Consumer Reports survey said they would buy a Model S again—more than for Mercedes, BMW, Porsche, or any other vehicle.

Consumer Reports’ annual owner-satisfaction survey covered 350,000 vehicles from one to three years old. Across all vehicles, the average satisfaction rate was about 70%. Participants were asked whether they would buy the same car again, and to consider “attributes such as styling, comfort, features, cargo space, fuel economy, maintenance and repair costs, overall value, and driving dynamics.”

The Tesla Model S scored well in all these categories, with 98% of owners giving a “definitely yes” answer as to whether they would purchase it again.

Keep in mind, all of the above occurred before some of the latest features were added to the car, such as the truly mind-boggling driverless Autopilot coupled with all the other over-the-air updates, which we’ll discuss in a moment, and before the number of Tesla charging stations was increased.

In Britain, the reaction has been similar, according to AutoExpress:

- In AutoExpress’s 2016 Drive Power customer satisfaction survey Tesla topped seven out of ten categories and achieved an overall record-high score of 97.46%.

- Model S owners raved about its 17” inch display, Autopilot features, and “Ludicrous” mode.

- Categories topped by Model S include: best for running costs, best for performance, best for road handling, best ride quality, easiest to drive, best for practicality, and best for in-car tech.

What really makes this car unique in automotive history is its ability to be upgraded over time without the need to buy a new car. This is accomplished through software patches and updates. Says Elon Musk in a L.A. Times article, “We really designed the Model S to be a very sophisticated computer on wheels. Tesla is a software company as much as it is a hardware company. A huge part of what Tesla is, is a Silicon Valley software company. We view this the same as updating your phone or your laptop.”

Topping all of this off is real-world experience and word of mouth. Tesla is not slowing down. People are just beginning to truly understand the value of this revolutionary automobile—and remember, the car and company have only really been around for six-plus years, as compared to the well over fifty- year average for most American and worldwide car companies. Tesla, with its very first iteration of its very first model, is already starting to eat everyone else’s lunch, as the following figures show.

U.S. Sales of Large Luxury Vehicles

| Model | 2015 Sales | 2014 Sales | % Change |

| Tesla Model S | 25,202 | 16,689 | 51.01% |

| Audi A7 | 7,721 | 8,133 | -5.07% |

| Audi A8 | 4,990 | 5,904 | -15.48% |

| BMW 6-Series | 8,146 | 8,647 | -5.79% |

| BMW 7-Series | 9,292 | 9,744 | -4.64% |

| Jaguar XJ | 3,611 | 4,329 | -16.59% |

| Lexus LS | 7,165 | 8,559 | -16.29% |

| Mercedes-Benz CLS-Class | 6,152 | 6,981 | -11.88% |

| Mercedes-Benz S-Class | 21,934 | 25,276 | -13.22% |

| Porsche Panamera | 4,985 | 5,740 | -13.15% |

| Total | 99,198 | 100,002 | -0.80% |

| Source: Tesla |

All of the above car companies are losing shares. Meanwhile, Tesla is gaining what they are losing (and this is before Tesla has even started mass-media marketing, as we will discuss).

Autopilot: A True Revolution

On a sleepy Thursday morning in mid-October, 2015, automotive history was made in classic Elon Musk style. Model S owners woke up with a radically new car in their garage. Thanks to a version 7 software upgrade, their cars now possessed a driverless feature. Yes, this incredible leap in automotive technology was accomplished via software. This was a surprise to everyone, and, as a business move, was pure genius. This revolutionary upgrade, “beamed” to 60,000 cars overnight, was accomplished without fanfare, and, perhaps more significantly, without regulatory red tape.

Before anyone knew what was going on, bam, the cars were on the street and driving themselves.

Autopilot is the company’s suite of semiautonomous tech that integrates software with cameras, radar, and ultrasonic sensors, to grant cars limited self-driving capabilities. According to USA Today, “About 60,000 of the 90,000 Model S’s on the road to date have the requisite sensors pre-installed for Autopilot.”

The enthusiasm for the upgrade was off the chart amongst consumers, publications, clean energy proponents—almost everyone. Now that the genie was out of the bottle, how were the regulators going to push back against it? Who was going to step out in front of all that enthusiasm and play the Grinch who tried to shut Tesla down? After all, elected officials need to get re-elected. This was a calculated and brilliant—albeit very risky—move by Elon Musk. Because if anything went wrong, it was his company on the line.

While everyone was caught up in the excitement, what were we doing at Prime? Keeping our eyes glued to the internet. On a daily basis. Why? Because our investment was on the line too.

We were looking for, and perhaps expecting, hundreds of auto accidents to be reported the next day—cars flying off cliffs, head-on collisions… But that was not what we saw. Yes, there were a few relatively minor mishaps, but there was also compelling evidence that the technology was actually preventing accidents. Even in its first iteration. We saw YouTube videos in which the car spotted a pedestrian coming—before the driver saw it—and in which the car sensed a swerving vehicle ahead of it in the driving rain and applied the brakes before the driver knew what was going on.

Again, yes, there have been some issues and complaints since Autopilot was released, but shockingly few considering the magnitude of what was being pioneered here. And the advantages have clearly trumped the disadvantages by a mile.

After a few days of watching this amazing development, we knew we were witnessing a revolution. Looking to the near future, we could easily imagine scenarios such as: having your car drive your kids to school while you monitor from home with a camera, or embarking on a car trip in Los Angeles and waking up the next day in Phoenix, fully rested and ready for your meetings.

Not only could driverless technology virtually eliminate impaired driving, but—as cars begin to communicate intelligently with one another—it could increase driving speeds while greatly reducing traffic jams and accidents.

That’s just the tip of the iceberg. The fact that 60,000 self-driven Teslas have already driven over a hundred million miles is ten times more impressive than these “futuristic” scenarios. Musk says that in three years Tesla will have a car fully capable of taking you to work while you are still asleep. As if that weren’t enough, “The system learns over time. The more people enable Autopilot, the more information is uploaded onto the network.” (Note: This bodes well for T-Mobile and other phone companies because almost all cars in the future will need to be Internet connected—see our 2014 T- Mobile discussion.)

On January 9, 2016, Tesla rolled out another over-the-air update, adding a new “summon” feature that allows cars to self-park without the driver in the car. “Version 7.1 of our software [allows] our cars to put themselves to bed,” says Musk.

In summation, Tesla Autopilot’s current and future capabilities render it a genuinely revolutionary technology. Perhaps the biggest single advance since the invention of the car.

With Tesla, it’s all about constant improvement. It’s not only about what you see today. Tesla has demonstrated an unbelievable ability to take the first step, but what’s really exciting is what it is poised to do in the future.

As Musk said in a Fortune piece (December 21, 2015), “I think we have all the pieces, and it’s just about refining those pieces, putting them in place, and making sure they work across a huge number of environments … It’s a much easier problem than people think it is.”

The point is that all the pieces are in place and now it’s only a process of refinement and improvement—in safety, speed, efficiency, etc. There will be problems, and things will go wrong. Elon may change vendors, systems, cameras, software, but with each step the product will get better. It’s a long road to perfection, but the road has been laid, and we are well on our way down it. What Musk has already done is amazing. We have great reason to believe that what he will do in short order will be world-changing.

The Timing Couldn’t Be Better for the Enhanced Safety of Driverless Technology

With traffic fatalities jumping unexpectedly in 2015—up by the highest percentage in the past 50 years—driverless technology has suddenly become all that much more critical and relevant.

Why the sudden increase in auto accidents? Lower gas prices and increased driven mileage may be one reason. But the use of smartphones to talk, text, or even watch videos while on the road, is likely another contributor, according to Warren Buffett, whose Berkshire Hathaway owns Geico, one of the largest auto insurers. One in four car crashes involves cell-phone use, according to NSC estimates,

even though most states have laws banning text messaging and hand-held cell-phone use while driving. At any given time, approximately 660,000 drivers are attempting to use their phones while behind the wheel of an automobile.

“If cars are better—and they clearly are—drivers must be worse (adjusted for mileage),” Mr. Buffett said in an email, as quoted by a WSJ article (September 15, 2015). The article also points out that “The upsurge in auto accidents after years of decline was an unexpected development for two of the three largest car insurers, Geico and Allstate.” And remember: distracted driving can only be expected to increase as mobile bandwidth improves and handheld technology becomes even more prevalent, making more and more online content and functionality available.

Driverless technology, even in its current state, goes a long way toward solving the problem of distracted driving. And since the technology is smart, it will only improve by leaps and bounds as it “learns” from its own collective experience and is continually refined by engineers.

While we don’t have a wealth of statistics yet, what we are seeing so far is that even the first version of Tesla’s driverless technology is not increasing accidents at all—and that’s an amazing base to work from to reach full autonomous driving. Worldwide, there is a fatality for every 60 million miles driven. The first fatality in a Tesla Autopilot car did not occur until over 130 million miles had been logged.

According to The Economist, “A study by the Eno Centre for Transportation, a non-profit group, estimates that if 90% of cars on American roads were autonomous, the number of accidents would fall from 5.5m a year to 1.3m, and road deaths from 32,400 to 11,300.”

Driverless technology is arriving on the scene at a perfect time to counter the dangers of smartphone use behind the wheel. In fact, Warren Buffett, while troubled by the recent upsurge in accidents, is equally concerned about the future of the car insurance industry in the face of this new technology. After all, with the improved safety of driverless cars, vastly less car insurance will be needed.

The Instrument Panel

Here’s a look at the production dashboard of a Tesla. This is probably not even close to as good as it will look in a few years, as the entire design of the car may change due to driverless technology (think bed, TV, even some excercise contraption possibly). This technology, even for Tesla, is changing with lightning speed, and it’s usually Tesla that’s outdoing Tesla.

As you can see, there’s a main dashboard digital display (left) and a central 17-inch touchscreen control panel (right).

As many other car companies struggle with basic automation and good dashboard design (as we’ll discuss later), the instrument panel on the Tesla is straight out of a sci-fi movie.

Its 12.3-inch LCD electronic instrument cluster (on the left) indicates speed, power usage, charge level, estimated range, and active gear, as well as Nav directions (powered by Garmin).

The Touchscreen (on the right) is a 17-inch panel divided into four areas. A top line displays status icons and provides shortcuts to Charging, HomeLink, Driver Profiles, vehicle information, and Bluetooth. The second line provides access to several apps including Media, Nav (driven by Google Maps), Energy, Web, Camera, and Phone. The central main viewing area displays the two active apps, subdivided into upper and lower areas. At the bottom is access to various secondary controls and settings such as door locks and lights, as well as temperature controls and a secondary volume control (above condensed and adapted from Wikipedia’s “Tesla Model S” article).

Again, it’s as much a sophisticated computer system as it is a car.

Convenient Service and Maintenance

Make no mistake, Teslas are far from perfect, and owners have reported a range of problems from leaky sunroofs to rattling noises to issues with the drive train, touchscreen panel, and power equipment. But that’s where Tesla’s superior repair service kicks in. According to an article in

Fortune…

In a regular car, if your water pump went out, the company wouldn’t give you a new motor… [Tesla] has an Apple Store approach to service. They’ll change the whole unit, give the customer a new one and then take back the problematic one, rebuild it, analyze what went wrong, learn from it, and put it into somebody else’s car that needs that part.

The company is known for replacing an entire electric motor within 24 hours instead of tinkering with one troublesome part on the unit for days…

It’s a smarter approach and it results in a lot less downtime for the owner…

And while replacing an entire electric motor might seem likely a costly approach, Tesla has managed to reduce its annualized cash costs of warranty… This number has dropped from

$2,033 per car in the second quarter of 2013 to $947 per unit in the second quarter of 2015—a sign that the company continues to make improvements.

While some parts in the Model S are expensive to replace, many are cheaper than ones related to a combustion engine…

Consumer Reports recently rated Tesla’s repair facilities as better than both dealerships and independent operators. “According to [CR’s] annual survey of subscribers, independent repair shops were rated higher in customer satisfaction than most franchised dealerships, with luxury automakers like Audi and Lexus rated higher than more plebeian brands. The one exception to that was Tesla’s official repair shops, which outranked even independent shops for on-time repairs, costs, quality, and overall satisfaction.” (Gas2, February 5, 2015)

Not that EV drivers spend a lot of time in repair shops. Electric technology has fewer inherent problems than internal combustion technology. For starters, electric motors produce less heat, because they have fewer moving parts, and don’t rely on controlled explosions (combustion) to make things move.

Electric cars don’t need multi-gear transmissions. This makes for greater efficiency and less wear, because transmissions act as a drag on the drivetrain. The lack of a transmission, exhaust, extensive lubrication system, and other complications integral to internal-combustion engines also makes electric powertrains simpler. There are fewer things that can break and fewer items that need regular servicing.

“The Tesla Model S actually requires little to no maintenance compared to gasoline-powered vehicles,” according to Clean Technica (Sept. 27, 2013), “due to the fact that it has very few mechanical parts that can malfunction. The only parts that require regular replacement are windshield wipers and tires. Brake pads will require replacement as well, but not nearly as often as those in gasoline-powered vehicles, since they are used much less thanks to regenerative braking.”

Gasoline propulsion systems, by contrast, contain a much longer list of components that can need replacing and that can fail…

Components that can need replacing include, but are not limited to:

- Electronic actuators to adjust various valves

- Ignition system

- Throttle controls

- Turbochargers (some models)

- Engine control unit

- Transmission control unit

- Oxygen sensor

- Coolant pump

- Fuel pump

- Oil pump

- Engine fan

- Transmission oil cooler pump (some models)

Components that can fail include, but are not limited to:

- Transmission

- Valves

- Spark plugs

- Crankshaft

- Connecting Rod

- Cylinders

- Camshaft

- Exhaust gas recirculation (EGR) system

- Belt and pulley systems for driving the alternator, engine fan, and other parts

Source: Clean Technica

An article in Business Insider sums it up best: “A Tesla powertrain (i.e. battery, motor, power electronics, charger) has 18 moving parts… An ICE powertrain (i.e. engine, transmission, drivetrain) has hundreds, maybe thousands.”

The battery for a base model Tesla is guaranteed for eight years or 125,000 miles (unlimited miles for its higher-end battery).

Side note: Auto parts retailers may be in trouble in the future. Not only do they have to worry about Tesla and the dramatically reduced number of parts its cars require, but they also have to worry about 3D printing, which can create auto parts, and Amazon, which can deliver parts more efficiently. A trifecta of trouble. Some parts retailers have additional problems. O’Reilly, for example, is a relatively large company ($26 billion) in a mature, saturated market that cannot grow much further and has almost a 30 PE! I’m not saying I’m going to short ORLY today, but just as Tesla was on my radar as a long position way before I stepped into it in 2013, ORLY is on my radar screen as a potential short down the road. Stay tuned!

The Performance

The Model S accelerates from 0-60 is less than four seconds, making it the most responsive car on the market, according to Consumer Reports. A Toyota Prius, by comparison, takes nearly 10 seconds to reach that same speed.

Tesla, on the other hand, is rapidly improving on even its current acceleration rates. The top-end Model S P85 D already had an “insane” mode capable of 0-60 in 3.1 seconds. Last year the system got an upgrade to “ludicrous” mode, which does 0-60 in a truly incomprehensible 2.8 seconds.

Only a few other production cars in the world can boast such acceleration, and all of them are either tiny, bare-bones models that hold only two people, or hugely expensive models that cost tens or hundreds of thousands of dollars more than the Tesla.

Tesla has “instant torque.” While other cars need time for their full power to kick in, the “ludicrous” Tesla Model S has all its power right there off the line. This makes the Tesla Model S the quickest production car in the world, in fact the quickest in history.

The importance of this kind of performance cannot be overstated. It is a huge selling point with consumers, especially those who test-drive the car. The Tesla obliterates the old myth that electric cars are sluggish, unsexy, and unresponsive. This is a performance vehicle that easily beats Porsches, Maseratis, and Jaguars off the starting line. It’s a car you want to drive, not just one your conscience compels you to drive.

Tesla’s Space and Comfort vs. Traditional Cars

Creating space in a Tesla has been a lot easier than it has been for gas-powered cars, thanks to Tesla’s trademark electric vehicle architecture. The lithium batteries are concealed within a remarkably thin floor-pan structure. Unlike traditional cars that have large engines taking up all the space in front of the car, Tesla’s hardware and engine are nicely tucked away, allowing the design team free play in creating space that other car makers can only envy.

That is why even the new Model 3 is going to have room for five adults “comfortably,” opening up floor space and leg-room for front passengers. All Tesla models have the design space to allow for exceptional safety, comfort, and baggage room.

My Own Case Study

This all sounds great, but sometimes a real-world perspective can bring it all home better than any theoretical or technical explanation can. With that in mind, I’d like to share a “case study.” Mine.

I recently bought a Tesla (Model X) for my wife, and we were invited to a friend’s 40th birthday celebration in Solvang, California. That’s a town in wine country north of Santa Barbara (if you’ve seen the film Sideways, much of it was shot there).

Strictly for the relevance of this story, I will divulge that I drive a higher-end car than a Tesla. But I wanted to take the Tesla on the trip because of all the cool features I knew it had, such as its ability to play almost any song in the world on vocal command and its amazing doors that open outwards and prompt my six-year-old to ask, “Daddy is the car going to fly?”

But the real reason I wanted to drive the Tesla was that I like to do personal research. I like to gain an intimate understanding of the companies I invest in.

As we pulled out onto the Pacific Coast Highway, I excitedly phoned Tesla customer service and asked them how the driverless technology worked. As the courteous employee—and I have to say, every Tesla employee I have come across has been exceptional—walked me through the steps, I soon realized how simple the technology was to use. It also had robust features that were quite handy, such as placing all the speed controls and settings on one easy-to-use control knob.

During the next ten minutes or so I began testing all the features and getting used to them— speeding up, slowing down, setting target speeds, changing lanes by using the turn signal, etc. There were about five times I found myself taking over control over the car. But each time, it was as a result of my panicking and failing to trust the system. When I realized the car was consistently doing the right thing, I knew I just had to get used to it and not panic so fast.

Autopilot handled the highway amazingly well, which quickly built my confidence. I was now going for prolonged stretches of time without touching the steering wheel, gas pedal, or brake pedal. The car, by the way, “notices” your passivity. When you don’t touch the steering wheel for a few minutes, the instrument panel will beep slightly while muting the music, and the screen will say something like, “Please put your hand on the steering wheel to maintain autopilot mode.” Another reassuring sign of the car’s practical “intelligence.”

I was giving the Tesla a workout, and it was passing with flying colors. You have to see this thing to believe it—the control panel, the screen showing other vehicles’ locations relative to yours, the almost perfect reading of the lane, the smooth centering. The whole integrated experience. Soon I did not even want to hold the steering wheel anymore. I remember thinking at one point, “Wow, I can’t believe other people are actually driving their cars. How inconvenient. How inefficient.” Amazing. I was already making the shift, in my mind, to a new era of personal transportation.

Now for the real test. Autopilot on winding roads. If you’ve been to Solvang, you know that after you leave the PCH, the road turns windy and leads up a mountainous region. Now, I don’t suggest anyone try this, because I don’t think autopilot is meant to be fully used on winding roads yet, but for the sake of research, I wanted to try it.

So I embarked on the winding passage, and the car handled the turns amazingly well. There was one time when it tried to take an exit I did not want to take, but this was an easy problem to correct by just tapping the steering wheel in the other direction. In fact, the experience was such a pleasure, I thought to myself, “I’d be happy to drive anywhere within a 5-to-6-hour range.” Most of us don’t realize how much stress driving causes, because we’re so used to it. The bulk of that stress comes from having to focus so intently. It’s much easier, I learned, to “oversee” a drive, as I was doing with the Tesla, than to execute every action and decision in detail. And for most long-duration trips, the bulk of the driving is on freeways, which the Tesla handled with ease.

There are so many bells and whistles on this car, it is hard to capture them all. And they’re not just for show; when you use the features, you realize how practical they are. For example, the car can be programmed to automatically elevate itself, via its suspension control, when it approaches the driveway of your house. The driver’s-side door senses what is around you and automatically opens when you approach the car and closes when you depress the gas. Once you try these features, you never want anything else. And the pace of Tesla’s advances is increasing.

All in all, the car exceeded my high expectations by a country mile. This is why personal experience can be so essential. It can tell you things no brochure or video or financial report can capture. I now knew that when people experienced this car it would be a turning point for them. I knew it in my bones. Would anyone really want to drive another car once they’ve tried one that can drive them to their destination refreshed, relaxed, and safer to boot?

From a Macro Perspective

A great product is only part of the picture, though. A smart investor looks at the industry as a whole and how the company fits into it.

If you look at the car industry, Toyota Motors has a $200 billion market cap, and it’s trading at about eight and a quarter times earnings. That means it’s making over $24 billion dollars a year in net income. That is a huge number. When well-managed car companies hit economies of scale and get past the initial investment phase, they can print money because the barriers to entry are so high. If you look at the top companies in the (internal combustion) car industry you have over a trillion dollars of value—all based around the same PE.

Then you have Tesla, all by itself, still at only a $30 billion market cap. That’s a recipe for great upside.

When vetting companies to invest in, Prime always looks for a “moat,” or a set of separators, that makes competition from other players difficult and can allow huge profits to be sustained and to grow. Just by virtue of being a viable player in the car industry, Tesla has already achieved a moat, and a large one at that.

First of all, the car industry is a very capital-intensive business. To start a car company takes several billion dollars, and even if you had your hands on that kind of money, you’d better get the product right the first time—which is damn near impossible in and of itself. (Tesla, amazingly, has done so.)

Distribution is another challenge; retail space for autos is extremely limited. Increased bargaining power of auto parts suppliers is another challenge, as are the economies of scale enjoyed by established competitors. These reasons, among others, are exactly why you rarely see major new entrants in the car industry. In fact, in America, the most prosperous, entrepreneurial nation in the world, no entrepreneur had successfully established a car company of any kind since Walter Chrysler did it in 1925.

To compare this to another major industry, let’s look briefly at the cell phone industry. In the past, substantial capital was required in order to enter this arena, but the cell phone industry is no longer capital-intensive. These days, “anyone” can start a phone company. This is happening all over India and China—and the rest of the world as well. Xiaomi, the largest phone seller in China, wasn’t even around seven years ago. A small group of people got together and decided to start making phones with a lower profit margin of only around $10 per phone. Nowadays, as soon as a phone comes out, you can dissect it, source all the components, use the Google Android operating system for free, and build the phone. And it’s not just Xiaomi; there is Lenovo, TCL Communications, ZTE, Micromax, Huawei, and more, all following the same game plan.

The point is, giant capital moats are getting harder and harder to find—unless they are in a dying business. The car industry, by contrast, has enormous barriers to entry. The type of competition you see in the phone industry simply does not, and cannot, exist in the auto industry.

Back to the point at hand. Tesla has already passed the point where it has overcome initial inertia— a huge hurdle—and has actually broken into the car market. The car exists. We have seen it and tested it. Tesla has built out factories and has managed to become an operating business without going under due to insolvency. This alone is a major feat. And most importantly, Tesla has built a better car than anyone else on its first try.

The point I am leading to is that if (1) you are in an industry with high barriers to entry, and (2) you are able to build a better product than all your competitors, and (3) they are all building one kind of product while you are building one that is fundamentally different (electric vs. gas), then you can eventually transfer much of the industry’s existing profits from other companies to yours. And all that net income, at very low PEs, translates to vast earnings.

And that income can now come at an accelerated pace. Why? Well, the average car is held for six years, but that is with the old technology that most cars have been using for decades. But with this exciting new technology—especially the radical new driverless feature—you can expect to see a dramatic uptick in the turnover rate at which people move away from older cars. Even if I’m fractionally correct, or even if drivers wait their full six years before switching technologies, this thing should be gangbusters. We’re talking trillion dollars of market cap and well over $100 billion in net income that’s out there and gettable for an extraordinary product that people really want.

Most important, for me at least, is that Tesla’s success is sustainable. We’ve already seen that it’s exceedingly hard, in general, for a new car company to enter the fray. But also, in the specific case of Tesla, existing companies don’t stand much of a chance against this company and its management. Typically, today’s car companies are run by CEOs sitting in luxury offices, far removed from their manufacturing plants. These appointed officers aren’t even the ones who brought their respective companies to where they are today, so they haven’t proven they possess the entrepreneurial know-how to take the company forward.

Elon Musk, by contrast, literally sits on the plant floor. With his exceptional work ethic, proven track record, and ingenuity—plus, now, the money behind him to do what he needs to do—I don’t see anyone in the industry, or on the horizon, who can catch up to him. We’ll talk about Musk a little more later.

But for now, to use an automotive metaphor, let’s shift gears.

China

According to a recent CNBC article, “China has already become the largest market in the world for EV sales, with 320,000 electric vehicles, including commercial ones, sold last year.”

James Chao, who tracks the Asian auto industry for the consulting firm HIS Automotive, predicts that number will continue to increase because of subsidies the Chinese government offers to encourage the sale of EVs. These start at $8500 and can often go higher.

The Chinese car market itself is huge and only getting bigger. Most American and European car companies are deriving an ever-larger portion of their profits from China. Just as we are seeing with many other industries, China is on a path to becoming the world’s back yard in terms of consumer spending. In case you didn’t realize how big the Chinese car market has become (and it’s still shocking to me), consider this: With a population more than four times that of the United States, China became the world’s No. 1 auto market in 2015, selling 24.6 million units as compared to 17.2 million vehicles sold in the U.S.

The problem is how to tap in to such a large and growing market. We wrote extensively in last year’s annual report about an idea we call “China-proofing.” That doesn’t mean ignoring or avoiding China; it means investing in companies that are strategically positioned to either take advantage of the growing Chinese market, or at least avoid getting hammered by it. China is the “elephant in the room” in the 21st century, and any company not factoring China into its competitive positioning is missing the boat in a huge way.

As investors, we look at China-proofing in a couple of different ways. One is the way we discussed in last year’s report. That means to be in companies that will not get eaten up by China’s advantages— for example, its vast labor force of 1.3 billion educated, hard-working people willing to work for a fraction of the costs of other countries. We don’t want to be in companies where China can re-create their product a little more cheaply, thereby eating up a larger and larger market share over time.

The competitive advantage other countries used to have is that they would import from China and sell into their local markets. Now, with China’s vast growth and wealth, not only does it have the ability to reach outside markets on its own, but it also has a massive domestic consumer base as well. So we like to be in companies that have a wide moat against this new reality.

But we also like to be in companies—this is our second way of looking at China-proofing—that can actually GROW into China. (One example of this is Activision, as China has recently opened up its domestic market to game consoles, and the Chinese are very active gamers.) This is not necessarily an easy thing to do. Most countries prefer local producers, and China is certainly no exception. It doesn’t really want American companies to succeed within its borders, especially if it believes them to be taking away potential business from local companies. We have seen, time and again, how China uses its clout to give advantage to its own companies.

That’s not to say American companies cannot do well in China. They can. But it’s the quantity or extent of penetration that is critical. That’s because the market opportunity is so vast, especially now that China is opening up and modernizing so rapidly. Every edge you can get matters, right now, and can make the difference between being moderately successful and ridiculously successful.

What advantage does Tesla have in China? Well, it’s a matter of life or death. Literally.

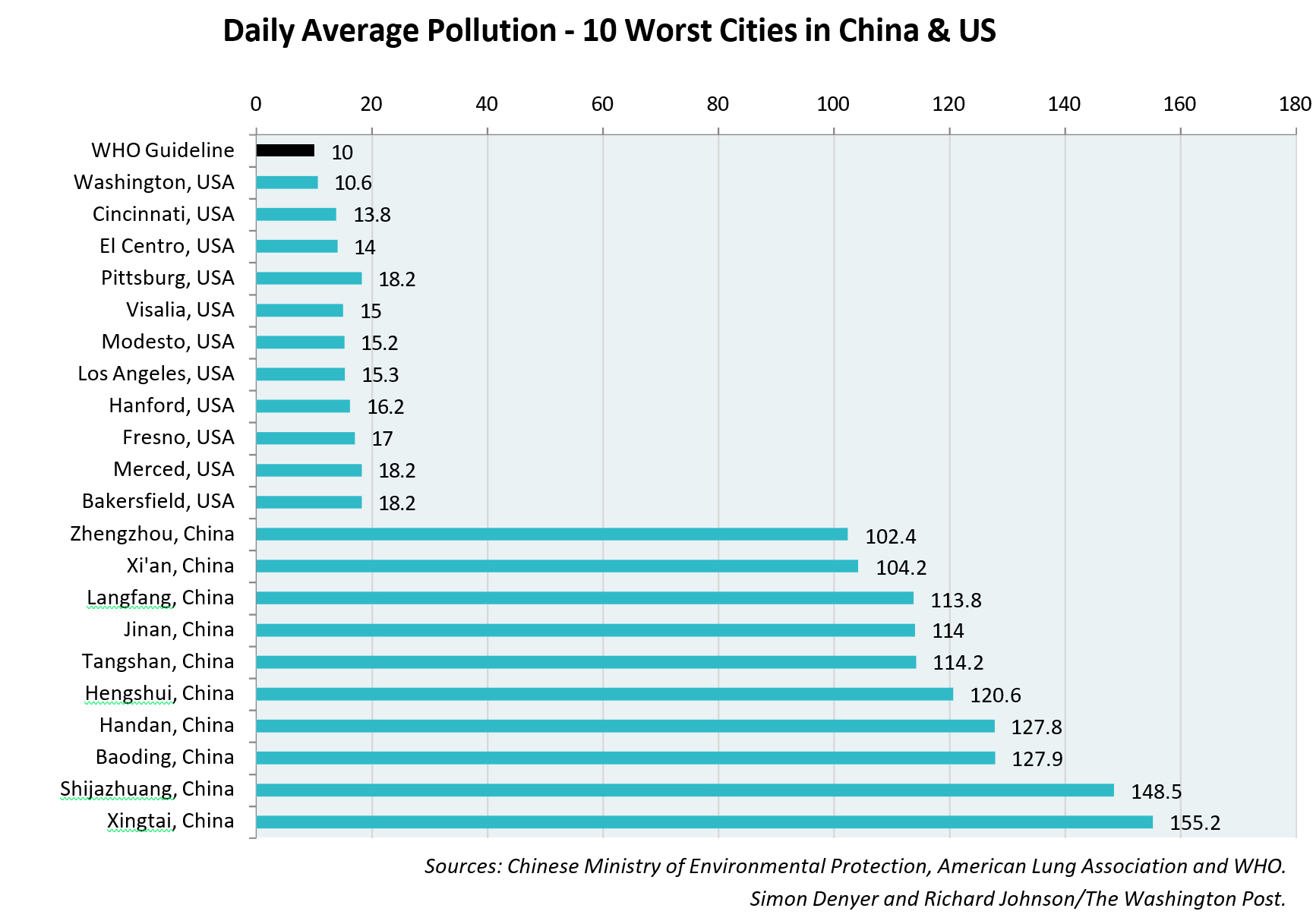

Air Pollution in China

An extensive study concluded in 2013 showed the link between air pollution and life expectancy in China. According to an article in the New York Times about the study, “Outdoor air pollution contributes to the deaths of an estimated 1.6 million people in China every year, or about 4,400 people a day.” Airborne pollution in China may have shortened the lives of 500 million Chinese by a collective 2.5 billion years.

To put it in even starker terms, air pollution causes people in northern China to live an average of 5.5 years less than even their southern Chinese counterparts; forget about comparing them to the rest of the world. And the consequences and severity of this problem have only gotten worse since 2013, due to continued industrialization and modernization in China.

Just to show you the urgency of the situation: The air pollution scale for all countries stops at 250 (micrograms per cubic meter). Beijing has seen readings of 500 or above. Shanghai had a 600+ “airpocalypse” this past winter. No one in North America or Europe has experienced anything comparable, except in the middle of a forest fire or a volcanic eruption.

Here’s a chart comparing the ten most-polluted Chinese cities with the ten in America.

As you can see, even the worst American cities would be in tip-top shape compared to Chinese cities. All of the above Chinese cities have over ten times the level of PM2.5 the WHO (World Health Organization) considers safe.

This is not just a Chinese problem. Financial Times (September 8, 2016) states that in 2013, an estimated 5.5 million lives were lost globally due to air-pollution-related causes. About 90 percent of these deaths occurred in developing/low-income countries where children under 5 are sixty times more likely to fall victim to air pollution than they are in wealthier countries. Such deaths are costing the global economy about $5.1 trillion per year. And remember, exposure to bad air increases the likelihood of developing a wide range of other medical issues.

The upshot of all this is that when it comes to Tesla cars, China and Hong Kong are a wide open market. And their governments support this. As a necessity. The Chinese people are literally dying for clean air.

None of this has been lost on Elon Musk. He recognizes both the long-term need for China to drastically reduce its overall pollution and the shorter-term need of Chinese individuals to reduce their level of smog intake immediately…

Tesla Offers an Immediate Solution

That’s why the air filtration system on the Model S, and now the Model X, is able to reduce the level of contamination in the car’s internal air from “extremely dangerous” to “undetectable” in less than two minutes. Yes, wow. Tesla says its filter is 100 times more effective than those on other cars and will remove 99.97% of particulate exhaust pollution, as well as allergens and bacteria. Tesla designed its filtration system to meet the tough HEPA standards of filtration systems used in hospitals and spacecraft. Says Tesla, “We wanted to ensure that it captured fine particulate matter and gaseous pollutants, as well as bacteria, viruses, pollen and mold spores.”

This filter is so good, Tesla says that it can withstand a military grade bioweapon attack. In fact, Tesla recently conducted a test of its Bioweapon Defense Mode, and the results were pretty impressive.

“To begin the test, they threw a Model X into a large bubble and pumped it full of PM2.5 contaminants (particles smaller than 2.5 microns), which are widely considered to be the most dangerous class because they lodge themselves so deeply into our lungs. They filled the bubble to levels roughly 18 times the ‘unhealthy’ index, or roughly four times the ‘hazardous’ index. Within two minutes of activating the Bioweapon Defense Mode, the air levels inside the cabin were safe to breathe. Within four minutes, PM2.5 levels were so low that they dropped under the threshold of detection. And here’s the kicker: the air outside the vehicle was being scrubbed too, with contamination levels dropping 40% during Tesla’s 12 minute test.” (Snapmunk, May 17, 2016)

Tesla management has the foresight to give the people not just what they want, but what they need.

Elon Musk sees the huge market potential in China and other emerging car markets. He also sees the dire situations in those places and wants to address it. According to a Forbes article (April 2, 2016), Musk recently described Hong Kong, the gateway to China, as a “beacon city for

electric vehicles,” and said that the city will have “the highest percentage of electric vehicles of any city in the world.”

The latest Tesla car currently available in Hong Kong is the Model S, and it’s already one of the most popular cars in the city since it started to arrive there in July 2014. In the above-mentioned Forbes article, Locky Law, the Tesla owner representative for an organization called Charged Hong Kong estimates that when the Model 3 arrives, 50 to 70% of new car sales in Hong Kong will be EVs, and almost all of them will be Teslas.

The Chinese government is putting forth a short-term, a mid-term, and a long-term plan for EV adoption. “The Hong Kong Government has shown a strong support of electric vehicle adoption by its initiatives to install charging stations throughout the city, and enact policies that favor purchasers of electric cars, including a registration tax waiver” (Teslarati, January 5, 2016).

Exemptions from registration taxes save Model S owners about HK$382,500 ($49,300). By contrast, the levy on a BMW 320i carries an added cost of HK$206,300, or about 38% of the sticker price.

Elon Musk said he thinks Asia will be the “biggest area of expansion” for Tesla in the next several years. His company plans a massive increase in Supercharger stations to accommodate that expected expansion. (He has also pointed out that most of China’s people live along the coast.

Therefore, the giant inland space could be used to install solar panels. “You can easily power all of China with solar [energy],” he has said. Musk, as you may know, is also chairman of SolarCity, a solar energy company.)

Restrictions and Regulations

Worldwide, governments are offering incentives for buying EVs and putting harsher restrictions on gas-powered vehicles. We see this in the U.S. as well. Internal combustion engines now face increasingly challenging state and federal regulations for emissions and fuel efficiency, and owners and manufacturers face stiffer penalties for failing to abide by these regulations. In addition to the federal and state subsidies already being offered, the Obama administration has proposed $4 billion in spending to support driverless technology over the next decade.

Carmakers face deadlines for reducing nitrogen oxide emissions (NOx) in the US and for increasing fuel efficiency and decreasing carbon dioxide (CO2) in the EU. This makes big changes unavoidable for the traditional car industry. Regulators and environmentalists, and others, have been trying to make gas cars cleaner for decades, but with the advent of electric cars, regulators are stepping up their efforts. According to ft.com, “By the end of the decade, the US, the EU and China will have brought in rules that it will be impossible for car manufacturers to comply with unless they embrace these new technologies.”

As a result, carmakers have even more ground to make up to hit the next round of targets.

All of this change will make gas-based car costs skyrocket, bringing more consumers and money into Tesla, and making Tesla cars more cost effective vs. their petroleum-based brethren. Now with diesel taking a hit from the Volkswagen scandal that saw 11 million cars being tweaked to cheat their emissions control, the pressure is on even more… and it all benefits Tesla.

Automakers are looking to move away from diesel altogether, due to increased regulations.

A Henry Ford-Like Vision: The Model 3

The whole idea behind Elon Musk’s Tesla was to start with a high-end car and then work down. The ultimate goal has always been to make a mass-produced car that’s affordable to all, thereby fulfilling Musk’s ultimate goal of transforming the world landscape for electric cars. Once you understand his grand vision, you can build your premises about Tesla’s future more accurately.

One of our big premises has always been that if Musk can build a high-end performance vehicle, then he can pretty easily build a lighter-end version of that car. After all, if you can do calculus, you can probably do simple multiplication too. And in our view, if Musk can indeed build an amazing, industry-defying, low-end electric car, the world will absolutely be Tesla’s oyster. The significance of this is impossible to overstate.

The big question was could he do it? Specifically: Could Elon Musk actually build a good low-end car for $35,000? If so, the sky was the limit.

Tesla recently unveiled the $35,000 Model 3. And it looks better than expected and is packed with more features than promised. The potential ripple effects from this development are staggering.

What Tesla basically did was to take all the componentry, along with the electronic backbone, of the Model S, which starts at around $70,000 for the base model, and give it to the Model 3. The Model 3 has the same engine concept, as well as all the same internal technology that goes into the Model S. It even has driverless technology. Think about it: The proprietary development of the componentry and software is already a sunk cost, it’s been proven to actually work, and it’s the heart of the new car. Hence, Musk rolled out the Model 3 with almost all the bells and whistles of the Model S. He even went so far as to thank all those who had previously bought a Model S for making this possible.

Here are some of the features and benefits you’ll get in the Model 3:

- A charge range of at least 215 miles

- Industry-topping safety ratings

- Access to Tesla’s “Supercharger” network of fast-recharging stations

- A zero-to-60 time of “under six seconds”

- Ability to seat five large adults comfortably

- The all-important Autopilot technology

To sum up, Model 3 will be a better car than many that are much more costly. Says Elon Musk, “You will not be able to buy a better car, any better car, for less than that.” And don’t worry, any temporary issues with the car’s features will be easily fixed—remember, this is the same technology as the Model S, and most of those bugs have had time to work themselves out.

Think about the pricing implications. Tesla sells the Model S for about $100,000, on average. The Model 3 will sticker for $35,000, before tax credits. This precipitous difference in price will have massive ramifications that we believe have not been vetted out properly either from a profit- potential perspective or a social change perspective.

Now, let’s talk about the potential ripple effects of this car and why I have had my eye on this prize since the day I first got into Tesla three and a half years ago. It starts with simple, back-of-the- envelope calculations that jump off the page.

Not only will Model 3 be the best car for the price—and, in my opinion, way beyond—but there is an additional factor that can have exponential effects.

Sit down for this one.

A Tesla for Less Than the Cost of Mobile Phone Service?!

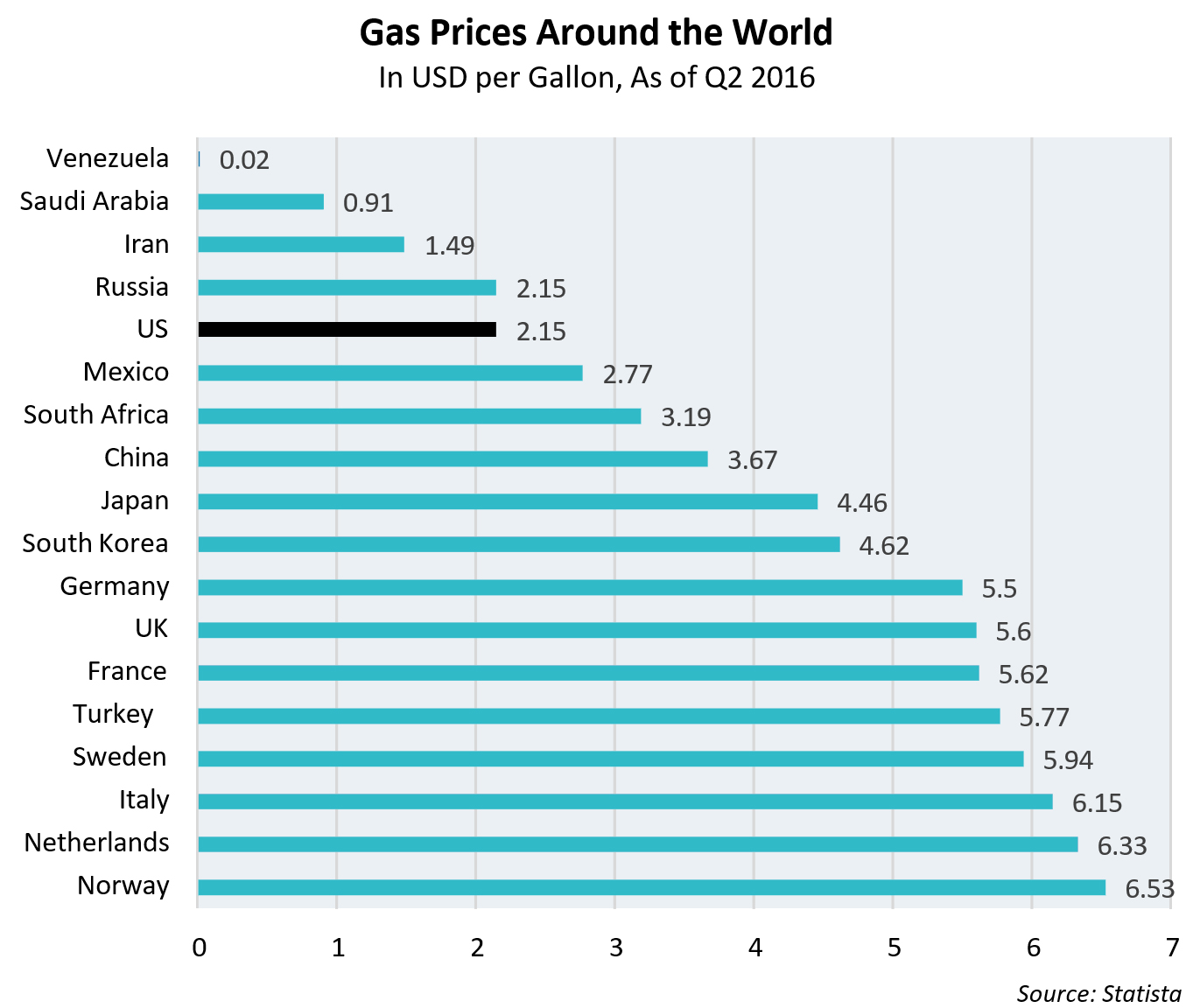

At a $35K price tag, the gas savings on this car in many parts of the world will be more than the lease payments —essentially giving you the car for free, or at least for an extremely affordable price! Many owners, when factoring their current costs, will actually be paid to drive the best car on the road.

Let me explain. First let’s have a look at a lease offer from the BMW 3-series. As a piece in Jalopnik (January 14, 2015) points out, you can drive a BMW for as little at $309/month for 39 months. If we look a little closer, we see that this payment is based on an MSRP of $35,300.00. A lease payment is determined mostly by the purchase price over the residual value. So, what if the purchase price on a $35,000 Tesla Model 3 were further reduced by $7500 in EV tax credits? Now we have a Model 3 with a purchase price of $27,500. Let’s also say the Tesla can maintain the same 60% residual value as the BMW.

I actually think it can do better than that, what with its driverless technology, its greatly reduced number of moving parts, etc., but let’s just say it matches the BMW. So just taking it proportionately (at its $27,500 purchase price), you would get payments of approximately $240 per month.

The second step in figuring the cost of ownership is to deduct the gas payments on a car, which averaged about $140.13 per month last year in the U.S., even taking into account the tremendously low price of oil right now. That brings the cost down to $101 per month for the Tesla.

Now let’s add back $40 for electricity used per month, a pretty conservative estimate, and you end up with a net monthly payment of $141! In Europe, where gas costs are generally 2.6 times more than in the United States, all things being equal, your $141 goes down to $-64.20 per month—you are essentially getting paid to drive a Tesla. In China, where gas costs are about 71% higher than in

the U.S., your cost is approximately $20 a month! (We’re using simple calculations to estimate payment savings. Some analysts suggest the payments would be even lower; some say higher.)

Now, just to keep things in perspective: Even with no gas-payment savings, I think the car, with all its features (pollution reduction, safety, technology features, speed, range, driverless tech), will be heads-and-tails better than any $35,000 car out there and will win huge market share on that basis alone. But with payments, in the United States, amounting to $141 per month, factoring in gas savings, it’s a no-brainer.

But let’s continue with the analysis.

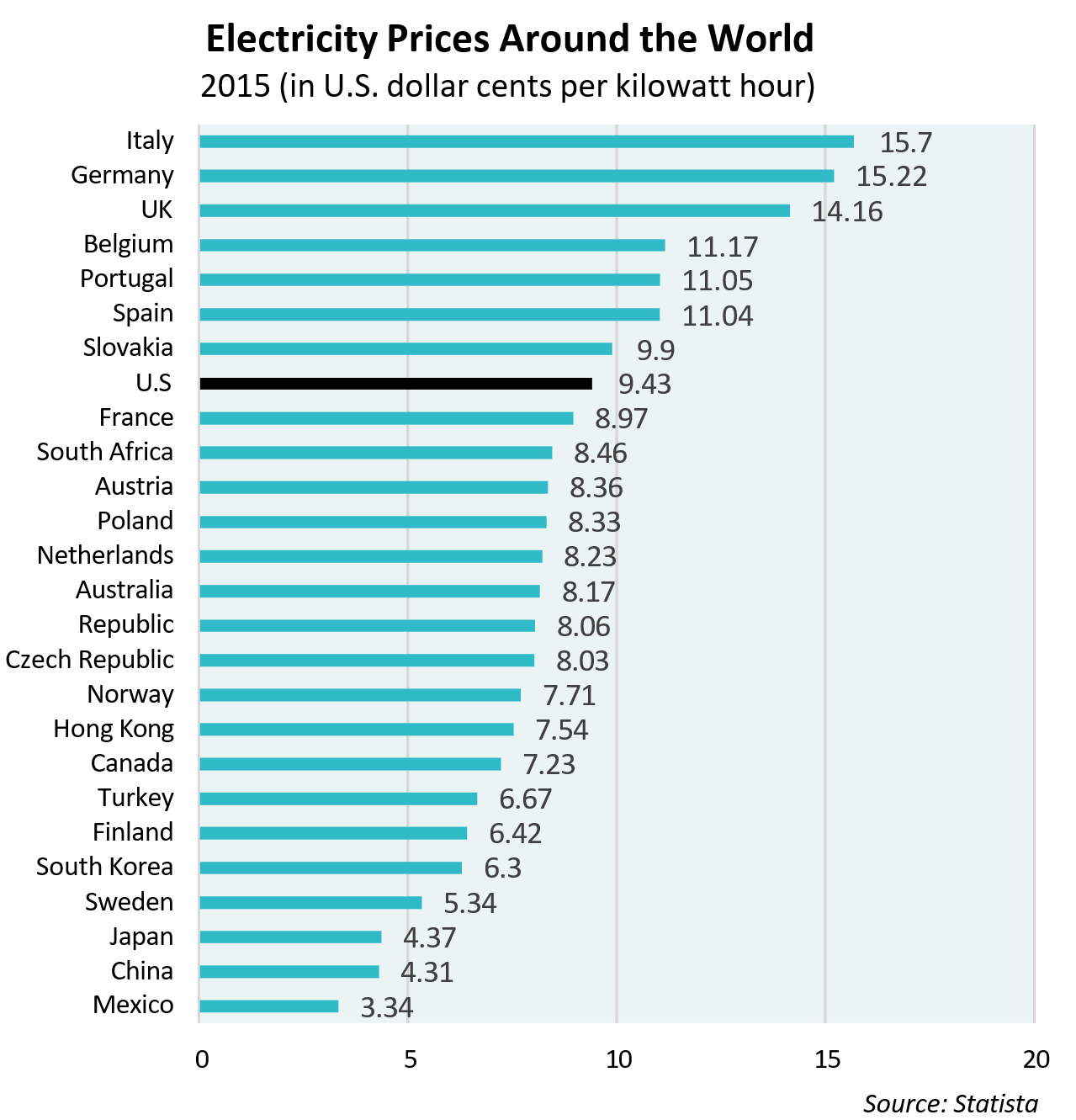

You can see that the United States has about the lowest gas prices in the world. And the higher the price of gas, the greater the savings with a Tesla. So globally, consumers will save even more.

The numbers, when you look around the globe, are mind-boggling. Tesla simply takes the money you would have been paying for gas and converts it into your lease payment.

Now let’s look at the electricity-cost side of the equation. We used $40 as our example for the United States. The U.S. is actually in the middle of the pack in terms of electricity costs; many countries are much lower.

Twelve of Europe’s biggest utilities companies had to reduce the value of their assets by over 30 billion Euros in 2015. Worldwide, energy and electricity prices are getting cheaper and cheaper, for a variety of reasons.

But, all in all, even if electricity costs come in at a fair amount more than $40 a month, it doesn’t move the equation much. And with solar panels, wind, and battery storage technologies being rolled out by none other than Elon Musk—along with other sustainable technologies—I would expect electricity prices to stay where they are, or, more likely, go down.

Another consideration: With much cheaper energy costs for the Tesla, people will drive more than they currently do—further increasing the savings. Many family plane trips, for example, will be out the window due to the reduced costs of driving and to the fact that roads trips will be a much more appealing option when the car drives itself. High-mileage users like cab and Uber drivers, heavy business travelers, delivery people, and others will have an even higher impetus to buy the cars.

And we haven’t even mentioned the potential reduction in insurance costs. Tesla already has the highest safety ranking of any car ever tested, and Autopilot is only in its infancy. When features such as auto warnings, auto stop, and smart re-routing become even more refined, there will certainly be a continued reduction in accidents for Teslas, which will bring the cost of insurance down.

But not to lose the forest for the trees, even when looked at from a worst-case perspective—zero gas savings—the Model 3, and all the other Tesla cars, will be dominant vehicles due to their coolness, reliability, speed, technology, and overall performance.

Throw in the gas savings and there should be smoke coming out of your ears.

Presales Going Wild

Now you can see why Tesla Model 3—even before all the features of the car have been revealed (Elon likes to under-promise and surprise)—is getting so many pre-orders, at $1000 each. Tesla has taken in about 400,000 orders and counting, to the tune of $400 million.

And I think Tesla and Elon Musk are still underestimating the potential. The staggering pre-sales of the Tesla Model 3 electric car seem to have caught everyone by surprise, including Musk himself.

This leads us to the topic of growth, and that is what really turns into profit. It’s one thing to have a great new concept or product—but when that concept or product is in an industry that has a huge market (understatement), then all this enthusiasm is warranted.

Growth Potential

We’ve talked about all the benefits of electric cars, and Teslas in particular. The question then becomes, “How big is the car market and how much of it can turn electric?”

First, some perspective on size. There are over one billion cars on the road today, and last year about 72 million cars were sold worldwide. In the United States alone last year, the value of new cars sold was greater than the value of all housing sold. This is an industry with trillions of dollars in annual revenue that employs over 240,000 workers in the U.S. alone.

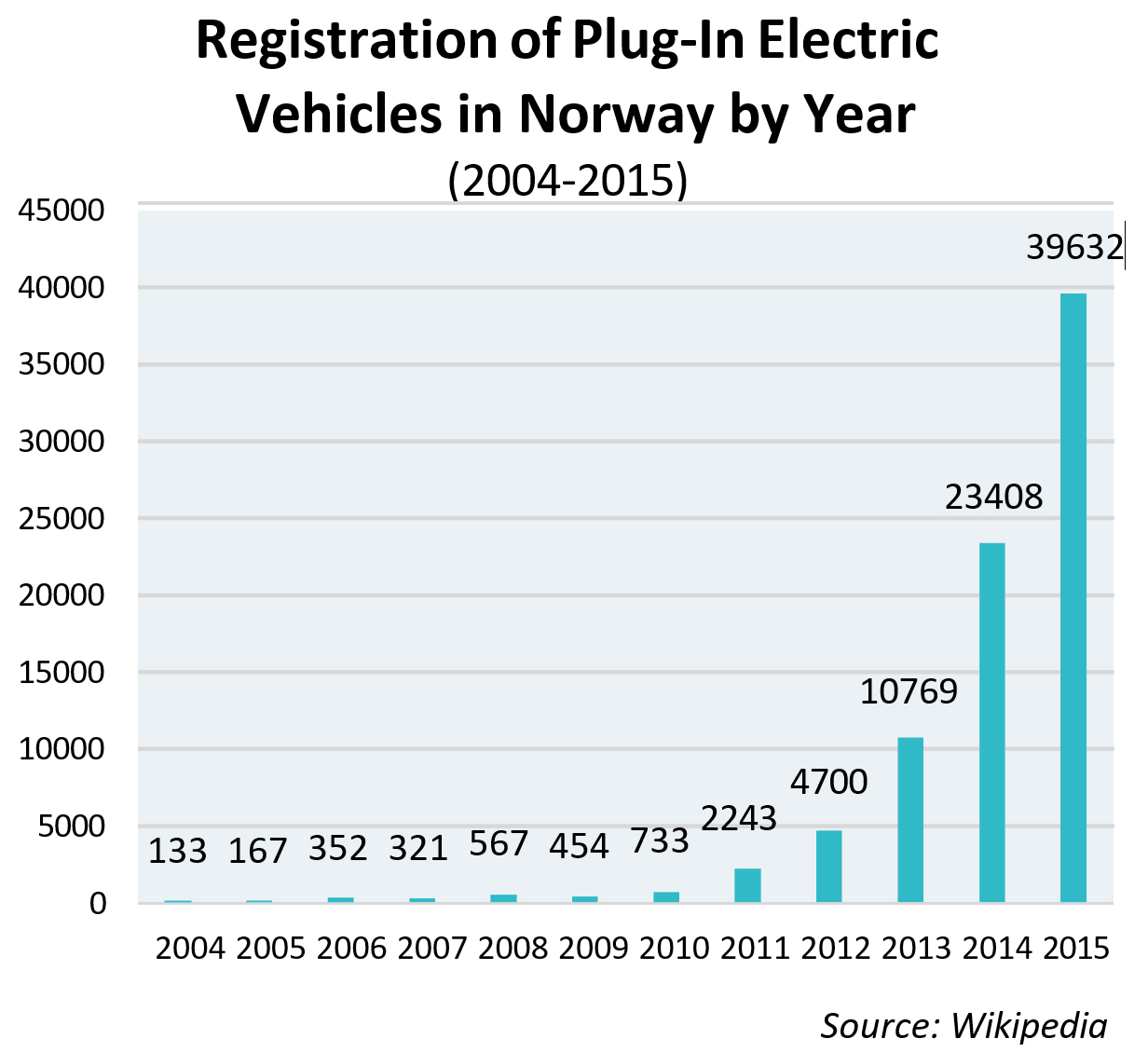

In terms of how big the electric car market, as a percentage, can get, let’s look at some countries’ penetration rates. Norway currently has the highest, with 18.5% of all new car registrations during the second quarter of last year being EVs, according to data from research firm IHS. Hong Kong’s penetration was 5.6% for that period, according to Charged Hong Kong’s data, putting that city in a tie for second-highest with the Netherlands.

As the case of Norway shows, penetration can change quickly. The above shows just q2 of 2015. By December, the rate had reached 22.4%, way up from 13.8% in 2014. The highest-ever monthly market share for EVs occurred in the March 2016 period—with a whopping with one in three passenger cars registered in Norway being a plug-in electric car (33.5%). As you can see, this is an incredibly fast-growing market as governments get behind EVs and the cars improve. It’s also a market whose growth will accelerate rapidly as the number of charging stations multiplies, mileage ranges increase, and people see their neighbors and family members going electric.

Tesla is the number one seller of electric cars in Norway. In fact, as of December, 2015, Tesla was the best-selling car overall in Norway. And that is with a $100,000 vehicle. A $100,000 car is much different from a $35,000 car (not to mention the addition of the high-end Model X now as well).

And the market is growing tremendously fast, right now. Not just in Norway, but all around the world.

All of this growth has been occurring without the availability, affordability, or deep consumer knowledge of the Tesla automobile—it’s a new car, priced very high in its current version, and on back order around the world. And again, all of this growth is before the $35,000 Tesla Model 3 has even been introduced to the market. Imagine how the market will grow with the right car at the right price, more charging stations, government backing, etc.

How much of the car market is Tesla eventually going after? After Model 3, Tesla is already planning on making an even more affordable car. Elon Musk: “I’m super excited about being able to produce a car that most people can afford. And there will be future cars that are even more affordable down the road. But with something like the Model 3, it’s designed such that roughly half of people will be able to afford the car. Then, with fourth generation and smaller cars and whatnot, we’ll ultimately be in the position where everyone will be able to afford the car” (source: WealthDaily, April 27, 2016).

Tesla doesn’t need to accomplish this goal in order to be wildly successful, but if it does, that’s all the more gravy.

What’s important to realize is that Musk is going for the whole kit and kaboodle. And I, for one, don’t question his ability to achieve it.

In January, he announced plans for “at least a few million [cars] a year” by 2025. But I think he underestimates the demand. Analysts predicted approximately 20,000 to 100,000 Model 3s to be ordered in the first year. But even with a $1,000 down payment just to order the car, and one-year expected wait times, Tesla surpassed that number in 24 hours. Even Musk seems to be shocked. He openly admitted that the blockbuster reservation numbers will require a change of plans: “Definitely going to need to rethink production planning.”

With 72 million cars being bought per year worldwide, I wouldn’t be surprised if the number of Tesla pre-orders hits well above 1 million even before the car is released. And remember, most of the world’s population is not even aware of this car yet. This is not a situation where demand will wane. In fact, my bet is that the car’s momentum will continue to build well after the initial excitement wears off. This is a pretty safe bet, given all the premises I’ve been outlining.

My “home research” bears out my optimism, at least anecdotally. On a test basis, I have spoken to four people about the Model 3 and all of them have either put in an order or say they will. (One was an Uber driver, one was a friend, one was a valet parking guy, and one was a guy who came to upgrade the gas meter at my house.) When people learn about the car, they want it.

Here’s one more point: In 2015, Jefferies conducted a survey of Model S owners and discovered that nearly 70% had previously owned a car that cost less than $60,000 (Business Insider). Tesla is not only moving people up, it’s moving them up by leaps and bounds. So if lower end consumers are willing to make the leap to the $80,000 range just to get a Model S, imagine what their enthusiasm will be for getting a Tesla for the same price as mid-range cars. Ludicrous.

In 2012, Musk agreed to what seemed to be almost impossible milestones… for others. Although he was given until 2022 to meet the goals, he’s hit half of them in only three years. His top goal is $43.2 billion in market cap. That makes him highly optimistic. But I would be even more so if I were him, now that I have studied the whole situation.

And Now, Let’s Hear from the Other Side

As you know, at Prime we’re all about finding the widest moat that will not only give us tremendous upside, but will also help limit our downside. That’s the essence of true value investing. It’s not a question of whether a company will be successful over the next year or so; it’s question of whether it has a substantial enough moat to outperform over the next five to ten-plus years, and in a big way.

So let’s take our analysis further to see what else sets Tesla apart from existing and future competitors. To do that we need to look, respectfully, at the concerns and opinions of our peers who might prefer to short Tesla. We want to know what everybody is thinking, because the more points of view we consider, the higher our chances of nailing the right valuation for the company—which leads to exceptional returns as well as the ability to get in at the right time, get out at the right time, and modify the position properly; a formula that has consistently set Prime apart.

This is usually one of the most interesting parts of any analysis—weighing the other points of view and dissecting them for contradictions or missed premises. As we have noted in past annual reports, reality will prevail in the end. And whoever gets the analysis more correct will make the most money. It’s that simple. Nothing emotional about it.

So… What is standing in Tesla’s way? What are people worried about? What do the naysayers say?

Let’s start by going back to the beginning, when we were receiving a lot of resistance to our pro- Tesla stance. We’ll look at some of the major concerns we were hearing when we first bought in, then we’ll look at some of the concerns we’re hearing today.

What They Were Saying Back Then

Here are some of the main arguments we heard against Tesla a few years ago…

“States are opposing the sale of Teslas.”

There was a lot of talk about how Tesla had an uphill battle because many states were considering banning their sales. And several states, including Colorado, Virginia, Arizona, Texas, and New Jersey, did in fact jump on that bandwagon. Most of the opposition to Tesla came from traditional car dealerships. These folks liked their cushy, protected business model and didn’t welcome the fact that Tesla was selling its cars through Tesla-owned dealerships and directly to the consumer.

Our View: Almost nothing can stop “an idea whose time has come,” and Tesla’s success is not dependent on any one state.

A. Politicians are politicians, and they want to be on the winning side with consumers. Elected officials may miss the boat for a short period of time, failing to understand the power of a movement, but they quickly learn the truth and change their positions. That is exactly what happened to the few legislators who got swayed by the lobbyists and tried to oppose Tesla sales. They got a mouthful, an earful, and an eyeful from their constituents. And they just as quickly changed their stance.

B. It didn’t really matter if states did oppose. Tesla was, and is, oversubscribed. No single state can stop its progress. If anything, the opposition only makes the car seem more enticing to many. Consumers in the states that initially tried banning the car could easily have a Tesla shipped directly to them, or buy one out of state and drive it home. When it comes to making a purchase of this magnitude, people are willing to be inconvenienced.

“Tesla has underbody problems.”

Starting in the second half of 2013, there were a few well-publicized fires in Tesla vehicles. These occurred when the cars struck a hard piece of debris on the road, which pierced the underbody and caused the battery to ignite.

Our View: If Tesla could build the best, most technologically advanced car, it could surely fix the underbody issue, which was relatively simple. Teslas are still safer than gas cars. And the underbody issue has, in fact, been resolved.

A. Most people don’t know this, but Tesla’s underbody problem was a result of a conflict between Tesla and Toyota engineers. The conflict originated when the two companies still had a partnership, before Toyota decided to sell out of its shares and pursue hydrogen fuel cell cars instead (a whimsical idea, for many reasons, including the fact that there are only twelve hydrogen fuel stations in the United States… but I digress). The Toyota engineers, when they were working with Tesla, argued that the underbody of the car needed no protection layer and that to install one would just add extra weight. The Tesla engineers, and Elon Musk, argued that the underbody should have protection, and strong protection. So they had to compromise. They added a plate, but it was thin. Well, guess what? Thin didn’t work. Tesla was right.Even with the underbody problem, Teslas were safer than gas cars. As Elon Musk correctly pointed out on Tesla’s website, “The odds of fire in a Model S, at roughly 1 in 8,000 vehicles, are five times lower than those of an average gasoline car and, when a fire does occur, the actual combustion potential is comparatively small.”

B. Tesla quickly fixed the problem. Tesla provided an over-the-air software update that increased the vehicle’s ground clearance at highway speeds. It then added a titanium plate and aluminum shields to its new models and promised to retrofit old models for free. There are now videos online of solid concrete blocks being crushed beneath Teslas. Problem solved. Better still, the world saw the willingness and ability of Tesla to make the world’s safest car even safer. (As a side note, I did sell off more than half of my Tesla shares after the third fire or so—because I could. Even though I knew Tesla would fix the issue, I thought another fire could easily happen over the next month or two and there might be some panic- selling on Wall Street. So I got out for a short while, then got back in again. As a result, we didn’t miss the upside—December was a great month for Tesla—but we protected our investors in the event that the problem took a little longer to fix.)

“There isn’t enough demand.”

There was a perception that, although most people thought electric cars were a good idea, the public wasn’t ready to adopt them on a wide-scale basis yet, due to performance issues and lack of “sex appeal.” Driving an electric car seemed like a sacrifice, kind of like installing a waterless toilet.

Our View: Demand is brisk and growing fast. If you can get a high-performing vehicle with tons of extremely cool extras, including Autopilot and a space-age dashboard, who in the world would not want an electric car? Especially when that price point comes down dramatically, as it will with the Model 3. ‘Nough said.

“There aren’t enough charging stations.”