A Few of Our Longs: Amazon, Google, and Tesla

At Berkshire Hathaway’s annual shareholders meeting in May of 2017, Warren Buffett admitted that he had made a mistake not buying Amazon and Google shares

At Berkshire Hathaway’s annual shareholders meeting in May of 2017, Warren Buffett admitted that he had made a mistake not buying Amazon and Google shares

He said he should have understood that Google had a strong advertising model years earlier, when Berkshire Hathaway’s own Geico insurance company was paying Google $10 or $11 per advertising click.

And as to why he did not buy Amazon, Buffett explained –

"I was impressed with Jeff [Bezos] early, [but] I never expected he could pull off what he did ... on the scale that it happened. At the same time he's shaking up the whole retail world, he's also shaking up the IT world simultaneously. These are powerful, powerful ideas with big potential, and he's executed."Warren Buffet, 2017

At Prime, on the other hand, we did buy Amazon and Google—Tesla too (in December 2009, October 2011, and January 2013, respectively). We’re not trying to suggest that we’re smarter than Warren Buffett, but we are saying that we believe we have an uncanny ability to spot companies and investments before others do, including (often) the “best in the business.” We have repeatedly been able to target companies whose values have gone up 200 percent and much more. We’ve had screamers in food (CMG), telecom (T-Mobile), and other sectors. Some of the investments we’ve made that have gone up over 100 percent include:

- Activision Blizzard (NASDAQ: ATVI), purchased 12/28/12, up 243.33%

- Amazon.com (NASDAQ: AMZN), purchased 12/31/09, up 465.62%

- Chipotle Mexican Grill (NYSE: CMG), purchased 1/21/09, up 731.17%

- Qihoo 360 (NYSE: QIHU), purchased 12/28/12, up 181.58%

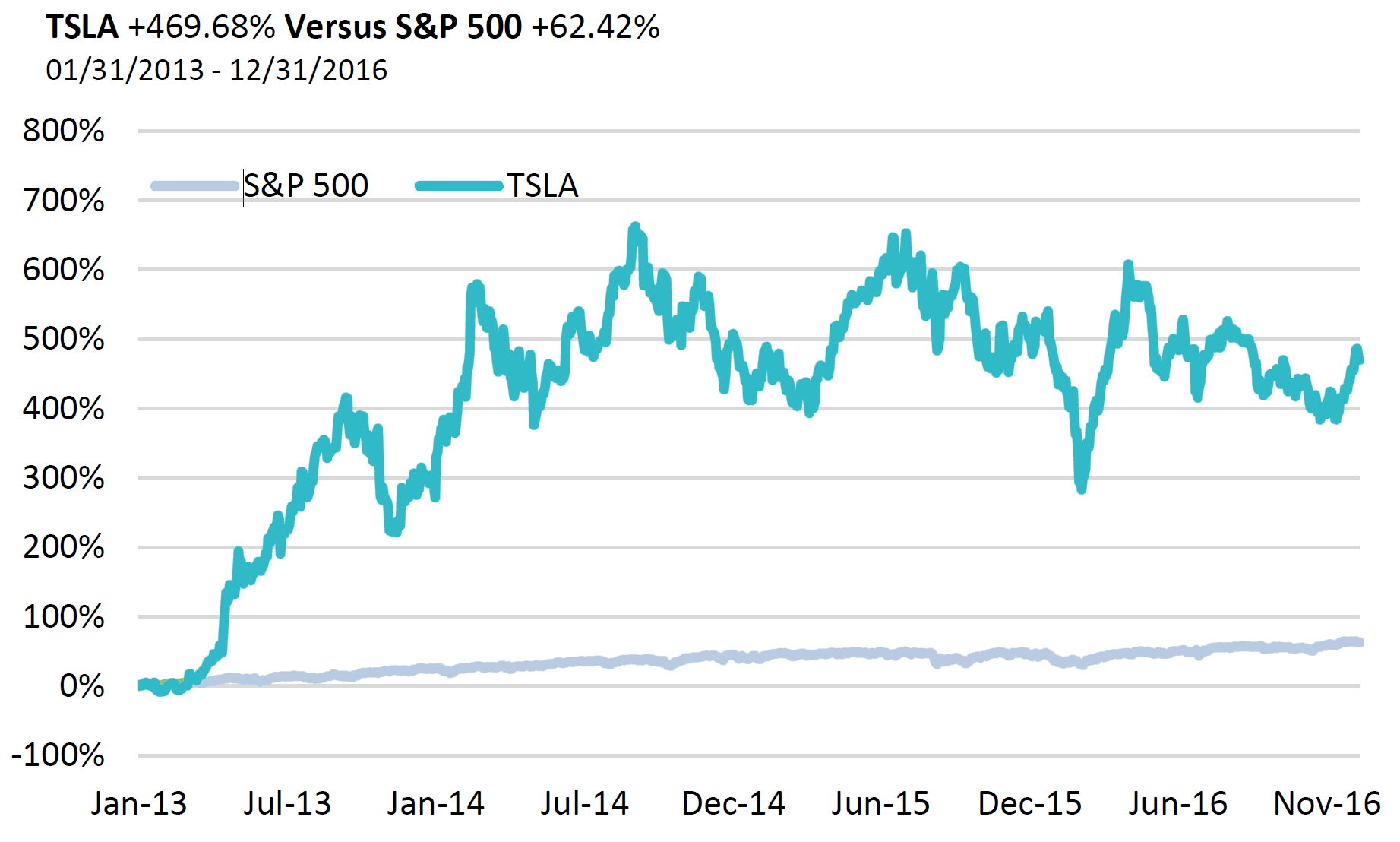

- Tesla (NASDAQ: TSLA), purchased 1/31/13, up 479.12%

- T-Mobile (NASDAQ: TMUS), purchased 5/14/13, up 206.14%

The combination of so many correct picks has been a major reason for our outperformance thus far.

But the essence of what we do at Prime is probably best exemplified in Amazon and Tesla (about which we wrote 50 pages in last year’s report). We have held Amazon for the past eight and a half years and got into it at $135.51 per share because we saw the writing on the wall from a mile away. Same thing with Tesla. This is a position we entered five and a half years ago, when the company was at a $5 billion market cap. And we and started writing about Tesla almost nine years ago. Tesla’s market cap, as you may know, is now around $60 billion.

Amazon and Tesla are perfect examples of hard-to-understand companies that we got a deep insight into early in the game, and that we fought through the naysaying and nonsense in order to buy and hold onto long enough to maximize earnings.

The moats and separation these companies have created, as well as their management teams’ ability to perform, has been well documented by us. We touted these winners with fervor well before their ascension, and have been long-term investors in them. Amazon and Tesla have been two of the best performing companies over the past five to ten years, and our largest positions.

With each passing day, more and more of our premises about these companies are playing out in real time. Amazon’s amazing CEO has shown that he has the vision to get into the right industries, master each structure and industry that he attacks, and just generally be at the right place at the right time. Amazon began its peaceful “coup” of the retail industry by delivering to the US market initially, then learning from that experience and taking those lessons abroad. In the process, Bezos has made Amazon China Proof. Even more than this, Amazon is now expanding dramatically into China, a challenge that would have eaten lesser companies alive, and has invested billions to become the top e-commerce player in India. In China, Amazon is leasing ships in order to master the logistics of delivering into that country. It is also taking low-cost goods directly from Chinese manufacturers and creating the same bulk practices it has perfected for its domestic products and sellers, such as capturing the eyeballs of millions of online users, putting ratings on products, making them searchable, and then delivering them in the US, straight to each household’s door. In the process, it is cutting out all the typical middle men—and widening the separation between Amazon and its competitors.

One more reason that we love Amazon? It turns all of the other retailers into perfect candidates for our shorting investment list, as we wrote about in the mid-year letter to our investors, “Long Airlines, Short Walmart.” There is obviously a lot more to the story of Amazon, as we’ve discussed at length in the past and will likely discuss again in the future.

As for Tesla, one of our main points about the company last year was that Tesla is light years ahead of its competition and has created a huge barrier to entry, both technology-wise and in terms of its manufacturing infrastructure—a double whammy. A recent WSJ article, for example, describes Ford Motors’ chairman, Bill Ford, leading a management shakeup to shift more quickly into electric vehicles, self-driving cars, and a future that incudes ride-sharing—the type of thinking Tesla was doing a decade ago. A sense of “Is this too little, too late?” pervades Ford’s efforts, which include rolling out a “shot clock” policy to implement changes more quickly and buying an autonomous technology company for over a billion dollars… so as to catch up. “The role we’re in now requires us to stick our necks out,” said Mr. Ford. “We’ve got to place bets. We’ve got to have a point of view about the future.” Yes, Bill, but Ford—and most other car companies—should have been saying this years ago.

In the current automotive climate, does it really matter whether Elon Musk meets his ambitious stretch goals on time or whether they come to pass six months later? Not really.

While orders for Tesla’s Model 3 have been coming in at 1,800 a day, most other car companies’ green-car sales have been lagging, according to an Autoblog article of August 3, 2017. Toyota’s sales in this market were down almost 10 percent during the first half of the year, then dropped 17 percent in July, with a 26 percent decline in demand for the four Prius variants.

Another point we wrote about last year is that Tesla can raise money very easily. It has done so twice already this year, for around $3 billion, and its stock didn’t dilute much—in fact, the stock actually went up in the most recent transaction because Tesla was able to borrow the money so cheaply—under 5 percent—without having to give up any equity.

Also, Tesla is China Proof, at least for the immediate future. Remember, China, because of its critical air pollution problem—which we described last year (ten times the acceptable pollution level in the US)—is in desperate need of electric cars. Why? Because all the people with money want to leave China and because pollution is seriously affecting both the length and quality of life for Chinese citizens. So, because Tesla is geared up to deliver EVs fast, China is behind Tesla. In fact, with the support of the Chinese government, Tencent, the large Chinese company mentioned above, recently bought 5 percent of Tesla for well over $2 Billion. If you can’t beat ‘em, buy ‘em.

This is probably the best I’ve ever felt about TeslaElon Musk

Amazon and Tesla are so far ahead of the competition that the distance is increasing day by day, not shrinking. Amazon’s competitors, and Tesla’s to a lesser extent, have realized of late that it is virtually impossible to catch up with these leaders from a time, money, and intelligence perspective. This is why we believe that three years from now, the discussion about these two companies, their moats, their CEOs, and their infrastructure will be more of the same—perhaps even at an accelerated pace. We have already written so much about these companies that we feel our case is made.

With companies such as these on our team—as well as the ten to twelve new investments we’ve found in the past year and a half—and with our ability to separate the winning strategies, businesses, and managers from the “fluff,” we think we can serve our investors extremely well.

The main point we want to emphasize is that these companies keep changing and so you have to get the bigger picture right—and then the smaller picture, and then all the details in between. That is why we have invested so much ink talking about key individual companies in past years.

Bottom line: Companies change daily, the ability to understand them does not.

It was our ability to understand companies, industries, and global trends that prompted us, for example, to get into T-Mobile back in May, 2013.